Unfortunately, we won’t be hosting Open Houses at this time, however our team has specific safety protocols in place that still allow us to show homes to interested parties digitally or in person by appointment. We encourage you to contact us to learn more!

Blog

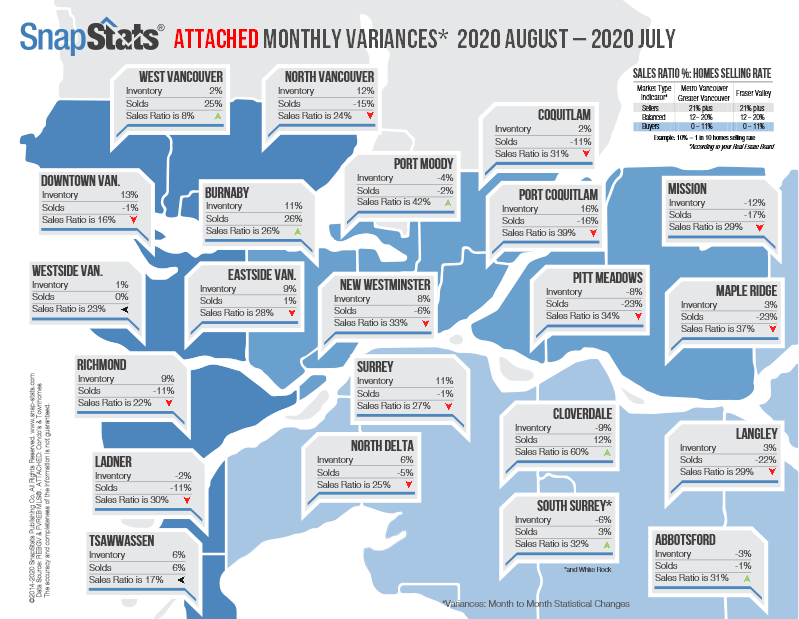

Snapstats

Want to learn about the latest market stats in your neighbourhood? Contact us today for this months SnapStats report!

Planning Your Renovation Effectively

With many of us spending more time indoors it might be time to tackle some projects inside the home! You have no doubt been dreaming up a few improvements for your space — the information below contains innovative, easy-to-use apps that can help you plan the perfect renovation! Need contractors or any service providers? We invite you to contact us, we are happy to put you in touch with our Preferred Partners.

Make Your Next Move Less Stressful & More Efficient With These Clever Moving Tips

Moving is definitely in the same category as doing your taxes or cleaning the toilet: you don’t feel like doing it but at some point you have to and there’s no way around it. These tips may help you save some time (and nerves) during your next move. Why do things the hard way?

Moving Boxes

A standard moving box always has grips. But if you wind up having to use more conventional cardboard boxes, then you can add your own grips by making slits with a box cutter. Don’t overfill the boxes though — you still need room inside to put your hand through the slit.

Continue reading →Update on residential tenancy laws

As announced June 19, 2020, the Province is maintaining the moratorium on rent increases and evictions for non-payment of rent. However, other notices to end tenancy may resume effectively immediately.

The moratorium on evictions has been in effect since March 30, 2020. As the Province moves forward with BC’s Restart Plan, the ban on evictions for reasons other than late payment or non-payment of rent has now been lifted.

Continue reading →Breaking News: Big Changes To Qualifying For A Mortgage July 1st, 2020

Effective July 1, 2020 CMHC is making the following changes to insured mortgage financing (an insured mortgage is when you have less than 20% for down payment/equity):

- Reducing the debt servicing ratios from 39/44 GDS/TDS to 35/42 GDS/TDS (Gross Debt Service/Total Debt Service). In English, this means that you’ll qualify for approximately 12% less than you do today. For example, assume you make a 70K and currently qualify for a 350K mortgage, you’ll now only qualify for 308K.

- Increasing the minimum beacon score from 600 to 680.

- Eliminating the ability to borrow your down payment.

These are significant changes to qualifying. As such, if you’re looking to get into the market and have less than 20% down payment, there’s no time like the present.

As of now, our sources indicate that the other two insurers (Canada Guarantee and Genworth) will not be following suit, but time will tell…

Please reach out if you have any questions.